Child ID Theft

Home Child ID Theft

Protecting Minors From Child Identity Theft

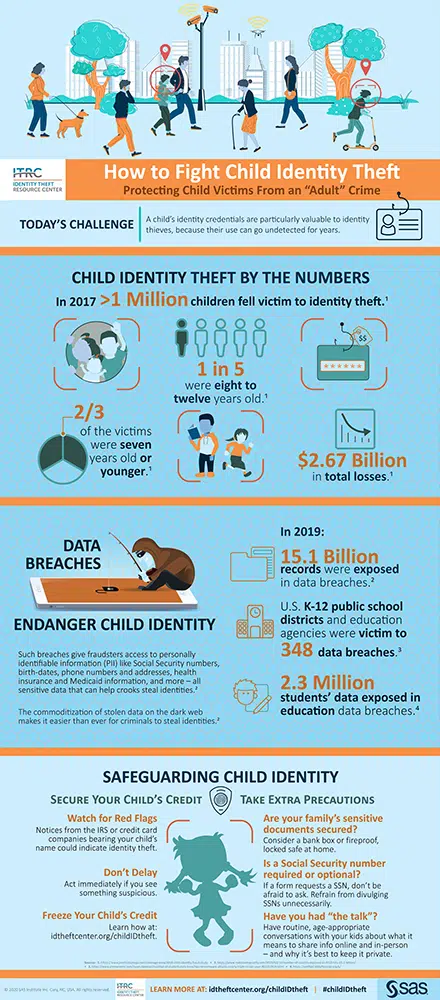

With as many as one million children falling prey to identity theft each year, it’s time for parents and industry to take action now.

The ITRC has received numerous reports of child identity theft in 2020, one of which includes two parents denied COVID-19-related stimulus benefits, leading to the discovery that an identity thief was using their 2-year-old son’s Social Security number. It’s one of many powerful stories heard by the ITRC in its 20-year history, each one illustrating a mostly invisible problem plaguing children of all ages.

According to a 2018 study by Javelin Strategy & Research, more than one million children fell victim to identity theft in 2017, with losses totaling $2.67 billion. The study further determined that more than two-thirds of child victims were ages 7 or younger, while 20 percent were in the range of 8 to 12 years old.

Read the full press release. To join the conversation on Twitter, follow the hashtag #childIDtheft.

Download Child ID Theft Infographic

How-To Place a Credit Freeze for a Minor

Start by checking if the child has a credit report in their name.

If there is no credit file for a child younger than 16 years old, or a dependent adult, you can request that the CRAs create a credit file and freeze the credit report immediately upon creation, at no cost, to prevent new accounts from being opened in the child’s or dependent adult’s name.

If your child is 16 or 17 and does not have a credit report, you will need to continue to monitor his/her credit.

A credit freeze for a minor or dependent adult cannot be done online, but each CRA has a website link explaining the steps you need to take:

Get ID Theft News

Stay informed with alerts, newsletters, and notifications from the Identity Theft Resource Center