Child Identity Theft Hotline and Live Chat

Home Child Identity Theft Hotline and Live Chat

Child Identity Theft Hotline And Live Chat

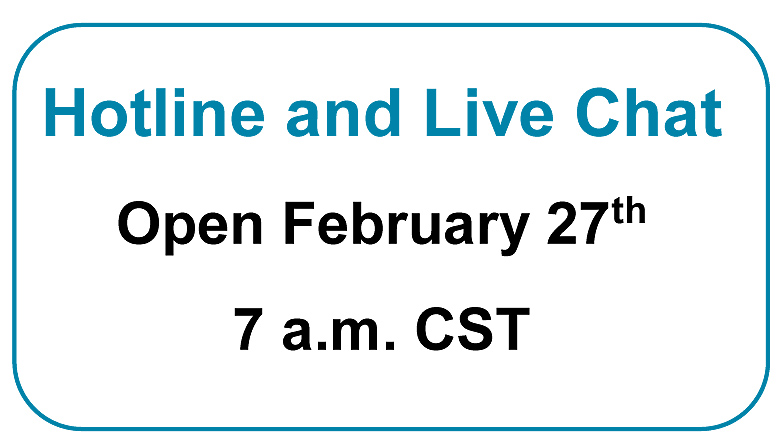

KSTP & ITRC partner to bring concerned parents information about child identity theft

What is Child Identity Theft?

Child identity theft occurs when a child’s identity is used by another person for the imposter’s personal gain. The perpetrator may be a family member or someone

known by the family. It could also be a stranger who purposely targets children because of the often lengthy time between the fraudulent use of the child’s information and the discovery of the crime.

There are some cases that appear to be identity theft but are not. Receiving a pre-approved credit card offer in your child’s name might upset you as a parent. However, it might only be an innocent marketing tool sent by an affiliate of your bank because you opened a college fund for your child. A quick check of credit reports will help you sort out the truth. Currently, all three reporting agencies use automated systems for ordering credit reports. You should contact them directly and request a credit report for your child. If you are told that there is no credit report, that is good news. The reality is that a credit report should not exist until that child’s first credit application as an adult.

What Parents Need to Know About Child Identity Theft

Though it may be surprising, children can be victims of identity theft too. In fact, they are often targeted because they have no credit history and the crime may go undetected for much longer as children do not use their credit. The below information will help you identify if your child may be a victim of identity theft and what you can do to clear your child’s identity.

If you are a concerned parent who wants more information about how to protect your child from identity theft, visit our knowledge base. Remember that no matter your problem or concern, we are here to help. If you aren’t sure about what you need, please do not hesitate to call the toll-free call center at 888-400-5530 for one-on-one assistance. You can also reach us through live chat or via email

Security Freeze Laws

Wisconsin: Wisconsin’s Child Credit Protection Act allows parents and legal guardians to sign up with the three major credit reporting agencies to protect their child’s credit record so that anyone seeking to open a new credit account in their child’s name cannot access the credit report; hopefully resulting in the rightful denial of their application. For more information on Wisconsin’s Security Freeze law, click here.

Minnesota: Minnesota doesn’t provide a specific law allowing parents to freeze a minor’s credit report before a problem occurs. However, any adult Minnesotan can impose such a freeze on his or her personal credit report for any reason. More information here.

How to Order Your Child’s Credit Report

Get ID Theft News

Stay informed with alerts, newsletters, and notifications from the Identity Theft Resource Center